Balancing the Books: State Fiscal Strategies in 2025

Nearly every state and territory will be in session by March, with fiscal policy emerging as a top priority for policymakers in 2025. This focus stems from significant budget gaps as states address deficits in critical areas like education and infrastructure, compounded by the expiration of federal pandemic aid.

Fiscal changes, whether through legislation or constitutional amendment, can be affected by increasing the cost of living and raising taxes, among other challenges. Tax revenue fell during the 2024 fiscal year, making it the first consecutive year of decline since the Great Recession in 2007-09. In 38 states, tax revenue is down from the 15-year growth trend. Despite this, state tax revenue is on track to restabilize, as the declines in 2024 were more gradual than those in 2023.

Top Issues

Housing

Bills addressing high housing costs were a focal point of 2024’s legislative sessions and are expected to increase in 2025. States may implement building projects and make zoning and permitting changes to strengthen their fiscal health.

Public Schools

Legislators are expected to explore new ways to fund K-12 schools in 2025, with schools becoming increasingly challenged by declining enrollments and reallocated federal benefits.

Gas Tax

Once a reliable source of funding for states, increased fuel efficiency and electric vehicles are lessening the impact of gas tax revenue. Legislators will likely look at new solutions to increase transportation funding support.

Tax Revenue Decline

Federal assistance through the American Rescue Plan Act will no longer support states in 2025, leading to deficits that may cause future challenges. As policymakers address program needs, priorities and fiscal strategies may shift accordingly.

Natural Disasters

States may create specific funding methods for natural disasters. In California, these programs allocate resources to mitigation activities, instead of pulling resources from firefighting activities. Other states use loans for those expected to receive federal assistance or provide incentives for local governments who invest in mitigation efforts.

State leaders must reassess their fiscal plans as they approach the end of American Rescue Plan funding and navigate the impact of tax cuts. They must also account for extreme fluctuations caused by the pandemic and its lingering effects in subsequent years. In particular, states in the Midwest and West are projected to cut local property taxes in 2025. States like California and Washington face significant budget gaps in the years ahead.

Washington

In Washington, state law requires lawmakers to balance the budget over four years. Heading into this year, the deficit is projected to top $12 billion over the next four years, meaning some combination of tax increases and spending cuts may be necessary.

Newly elected Washington Gov. Bob Ferguson has proposed a 6% reduction to most state agencies and a 3% cut to higher education to meet the state’s budget goals.

California

During the 2024-25 budget process, California lawmakers began with a nearly balanced budget but faced a projected deficit of approximately $2 billion. Under state law, the governor is required to submit a balanced budget proposal by January 10 each year.

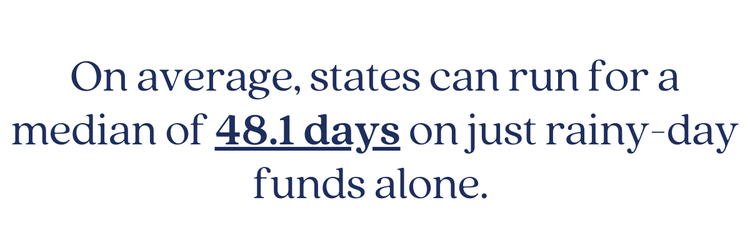

In response to the shortfall, legislators identified around $11 billion in spending cuts and $15 billion in additional solutions, which included $5.5 billion in temporary revenue increases and a $7 billion draw from the state’s rainy-day fund.

Louisiana

State leaders may look to examples like Louisiana, which adopted similar cuts last year, to better evaluate the impact of such changes.

Last November, lawmakers in Louisiana cut approximately $1.3 billion after approving a flat 3% income tax rate.

Beyond fiscal legislation, many bills can impact a state’s economic health. Legislators can mitigate expenditures by amending a bill to reduce its scope or required costs, implementing a “no appropriation” clause or requiring the use of outside funding when possible.

Analysts are projecting that state budgets will tighten; especially as federal pandemic aid is no longer available. Additional concerns include declining transportation revenue due to increased electric vehicle use and the adoption of AI to standardize operations and manage education costs. Even with changes in 2024, states like New York will still need to address statewide deficits in the 2025 legislative sessions. Such financial challenges underscore broader trends in state budgets, particularly as general funds, for the first time since 2011, experienced a slight decline for fiscal year 2025, according to the National Association of State Budget Officers.

While most states’ tax collections dipped below their 15-year trend, 12 states came in above their projected 15-year mark: Alaska (118.5% above trend), New Mexico (16.5% above), Wyoming (10.9%), Nevada (4%), Rhode Island (3.7%), South Carolina (3%), Montana (2.7%), North Dakota (2%), Texas (1.7%), Alabama (0.6%), Florida (0.5%), and Nebraska (0.2%).

As policymakers anticipate the challenges of 2025, fiscal policy will remain at the forefront of legislative agendas. In response, innovative solutions and careful planning will be essential to stabilize budgets and foster long-term economic growth — efforts crucial to supporting the states.